Is US Dollar Bottoming?

US Dollar impact on commodities prices

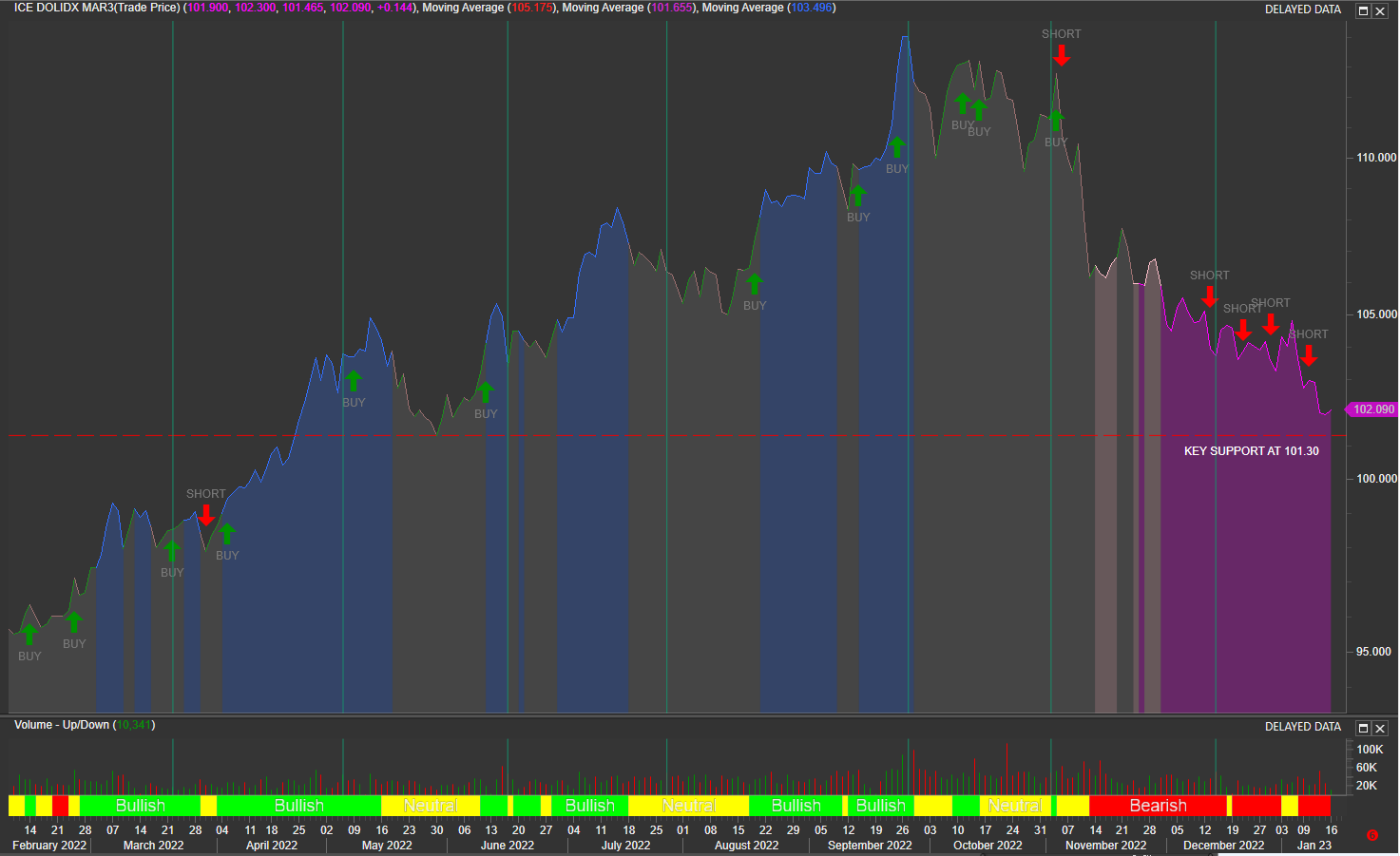

After 7 Federal Funds interest rate hikes during 2022-year, US Dollar Index DXc1 future have formed a technical multiple top formation between 114 and 109. Then, DXc1 index lost support to carry out a fast and potent down move into the next 105 technical support area, which was also broken-down on momentum to continue into the current 101-102 demand area.

Dollar Index DXc1 prices are right now challenging the 101 USD critical demand area, which is essential to be held by US DOLLAR bulls (buyers) to start any serious attempt to drive prices up into the 110-115 area.

DxC1 Dollar Index future contract in Daily Time Frame. Chart provided by Metastock powered by Eikon-Refinitiv. SMART Alerts provided by e-globalTrading-TradingVest USA

Note the vertical green lines marking the 7 FED interest rates increases events, and also, note the high momentum bullish periods on blue color background and the current high momentum bearish period on magenta color background.

As observed on the corresponding Daily time frame DXc1 chart, the referred FED action increasing the federal funds interest rate in 4% basic points, finally achieved the goal of empowering the US currency to also decrease local prices, but not at the level the FED wants. This situation has triggered a discussion about the origin of the current inflation process and the eventual possible solutions.

We see several variables still impacting current inflation during the past 2022 period, such as the Federal Government spending and the corresponding financing solution, which is obviously the astronomical Federal Government debt, via US emission and Treasury Notes. This situation is certainly destroying the US Dollar structural stability; US Federal debt is currently totalizing about 31 trillion Dollars or 125% of US GDP! This madness is not sustainable at all! At the same time, recent minimum wage increase in several states also impacted costs to certainly impact consumer prices.

In short, FED simply used its traditional recipe to cool the economy, but structural inflation is still in place.

Going back to our original question: Is this 101-102 DXc1 a possible bottom for commodities reference prices?

From the technical point of view, the referred 101.3 looks like to a very simple support to be broken, so we must define the referred 101.3 challenge first. In the case the support is broken, DXc1 has room to continue down to challenge the next serious support into the 98 area.

Thus, our answer is that we must wait to confirm if the 101 area is support or resistance, before declaring the possible support area as a formal US Dollar DXc1 bottom.

Current magenta color background indicates we have still chance to continue down on momentum, possibly because the red dashed support at 101.3 doesn’t look too strong to halt the current down-trending.

If DXc1 finally breaks down, commodities in general and specifically, crude oil, will receive a strong bullish impact to be balanced with supply-demand influence, which is currently a bearish factor because current global consumption concerns.