Where Ethylene and Naphtha Prices are Heading to? – July 29th, 2020

After almost 6 months of pandemic, energy and petrochemical markets recovered prices from their bottom. Ethylene bounced 100% and Naphtha recovered almost 200% since April 2020; but both petrochemicals are still struggling to overcome their last February price level.

Both downstream petrochemicals prices are now steady into some resistance areas, so we will analyze what technical analysis is telling us, and where prices would be heading to.

Let’s take a look at both daily charts.

If you belong to the group of people concerned about dealing with crude oil priced at 0 US$ or even lower, let me tell you that this is not going to happen very soon. However, if you were reading our articles about why oil prices were going down for almost 8 years, you certainly know what we are writing since the beginning of 2015.

The crude oil price is now being impacted by multiple bearish factors, all of them making an extraordinary down pressure on the oil price. Those factors are strong structural variables directly related to different important sources, all of them responsible for the current technical downtrend.

Where Ethylene and Naphtha Prices are Heading to? – July 29th, 2020

After almost 6 months of pandemic, energy and petrochemical markets recovered prices from their bottom. Ethylene bounced 100% and Naphtha recovered almost 200% since April 2020; but both petrochemicals are still struggling to overcome their last February price level.

Both downstream petrochemicals prices are now steady into some resistance areas, so we will analyze what technical analysis is telling us, and where prices would be heading to.

Let’s take a look at both daily charts.

ETHYLENE SUPPLY

Shintech's 500,000 mt/year Louisiana cracker started up in mid-February,Indorama Venture's 440,000 mt/year cracker in Louisiana restarted in early February, and Formosa Plastics' 1.5 million mt/year cracker in Texas restarted in January.

US POLYOLEFINS SUPPLY

USA LLDPE grades increased due to talk of tightening supply for spot players

US PP rose half a cent last week and is expected to trend higher in the short term, market participants said. Sellers pointed to supply tightness amid a heavy maintenance season to explain higher pricing.

e-globalTrading

ENERGY MATRIX

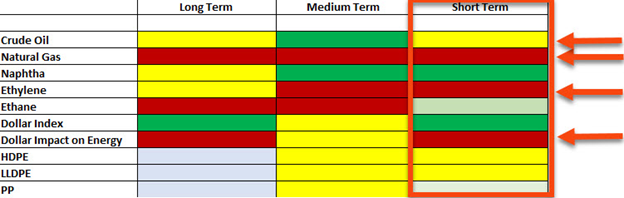

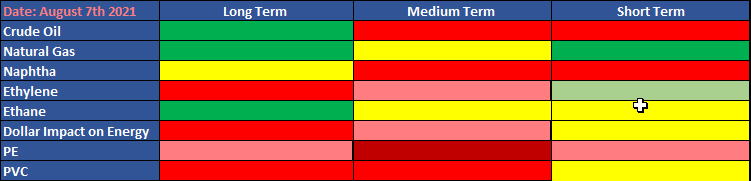

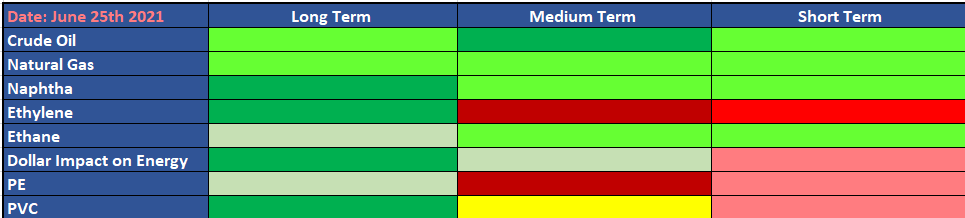

The e-globalTrading Energy Matrix is showing up-stream energy instruments extremely bullish, while polymers are showing clear weakness, driven by ethylene.

Energy Drivers Starting to Show Technical Alignment into Down Direction as Polymers Prices Look Steady