by Ed R. Gils - TradingVest President

January 2023 had a couple of big market giveaways for traders and investors. China finally started to lift its rigid COVID restrictions policy for internal circulation and travelers. The second relevant market news event was the sequence of positive market data showing signs of inflation easing.

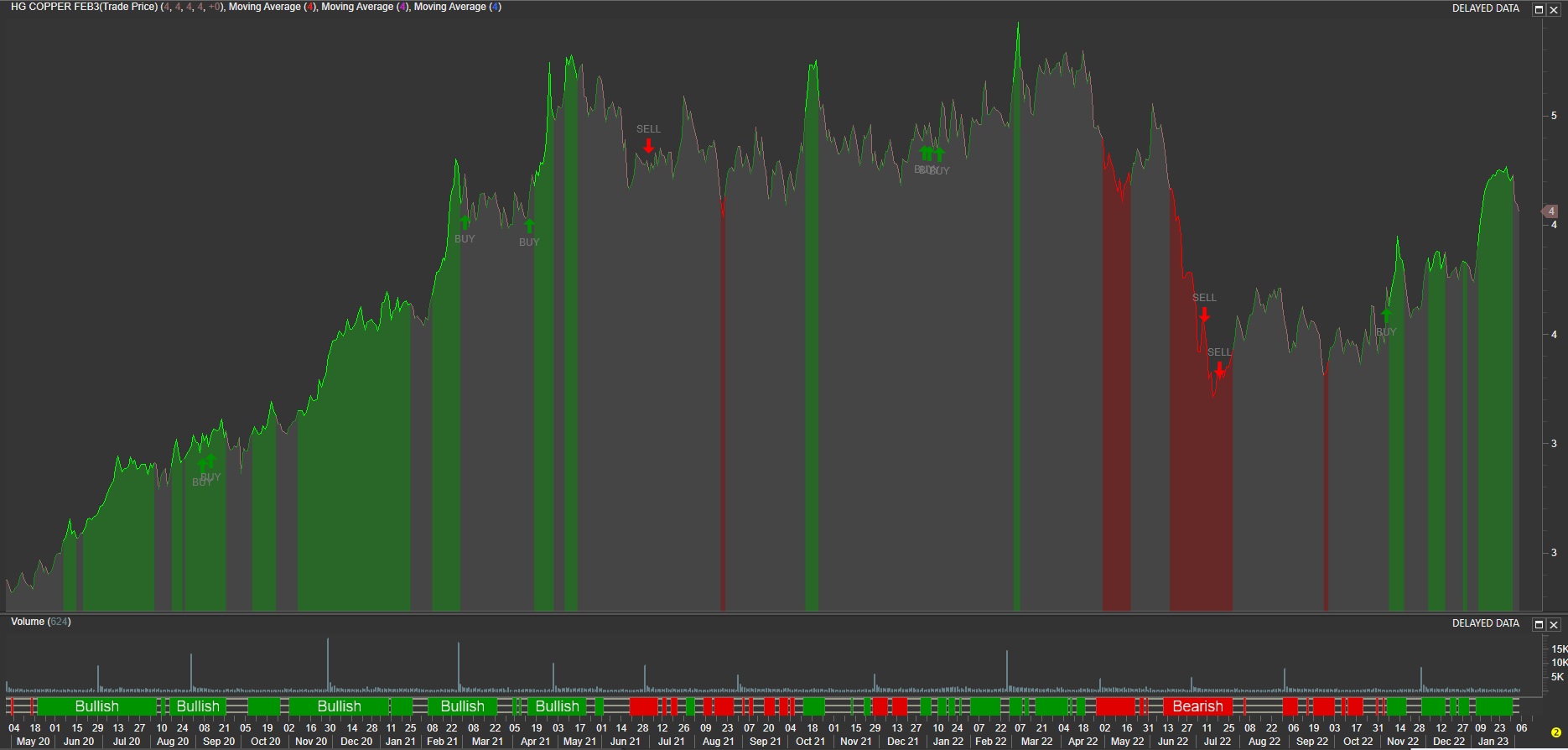

Among the sectors we like the most, the metal commodities sector shows HG Copper as one of the most promising instrument to put on your watch list, from any point of view, technical and/or fundamental.

Let’s take a look at the corresponding Copper futures chart,

COPPER Daily Chart provided by MetaStock, Alerts provided by e-globalTrading-TradingVest USA

From the fundamental point of view, as China has recently lift COVID restrictions, the construction market will certainly increase the building materials consumption demand, which will probably consolidate demand for copper and HGc1 futures instrument.

Note how the e-globalTrading green color background was on several times recently, which is a promising signal to trigger BUY alerts any time soon. Just wait for the e-globalTrading Alerts to make a conservative decision.

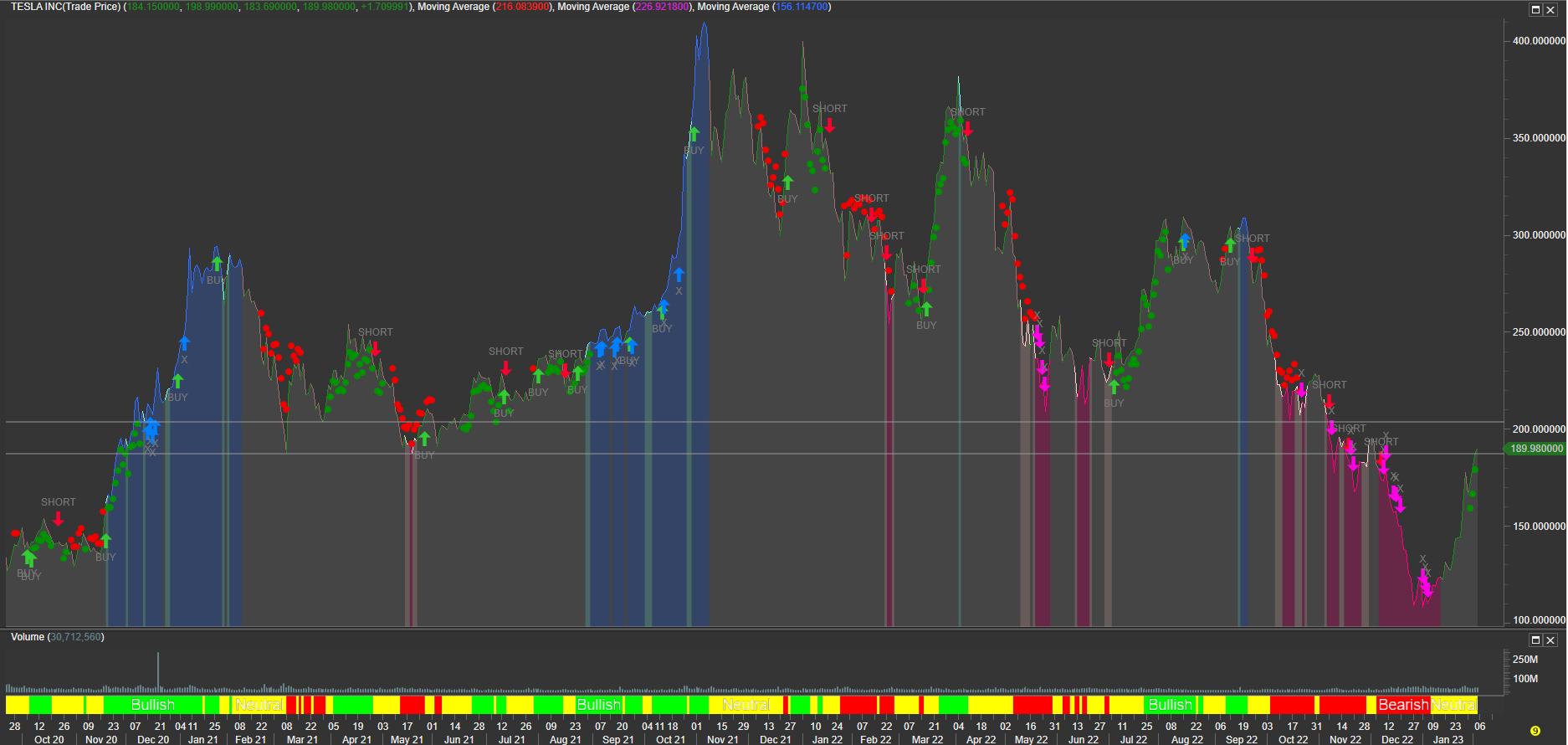

Other interesting sector is EV automotive, which had several announcements recently, and certainly TESLA was one of the most bullish automotive technology stocks since January 20th 2023 to lead the sector bounce.

TSLA also announced a strong EV price reduction to increase sales, which will add a lot of competition to the EV sector. At the same time, FORD also slashed its EV prices to full fill the competitive situation.

Going to technical, TSLA Daily Chart is now showing the EV maker preparing a possible breaking move into the 190-200 USD resistance area.

Also Note a few early “green dots” bullish alerts prompting the referred bulls team attempt.

TLSA Daily Chart provided by MetaStock, Alerts provided by e-globalTrading – TradingVest USA

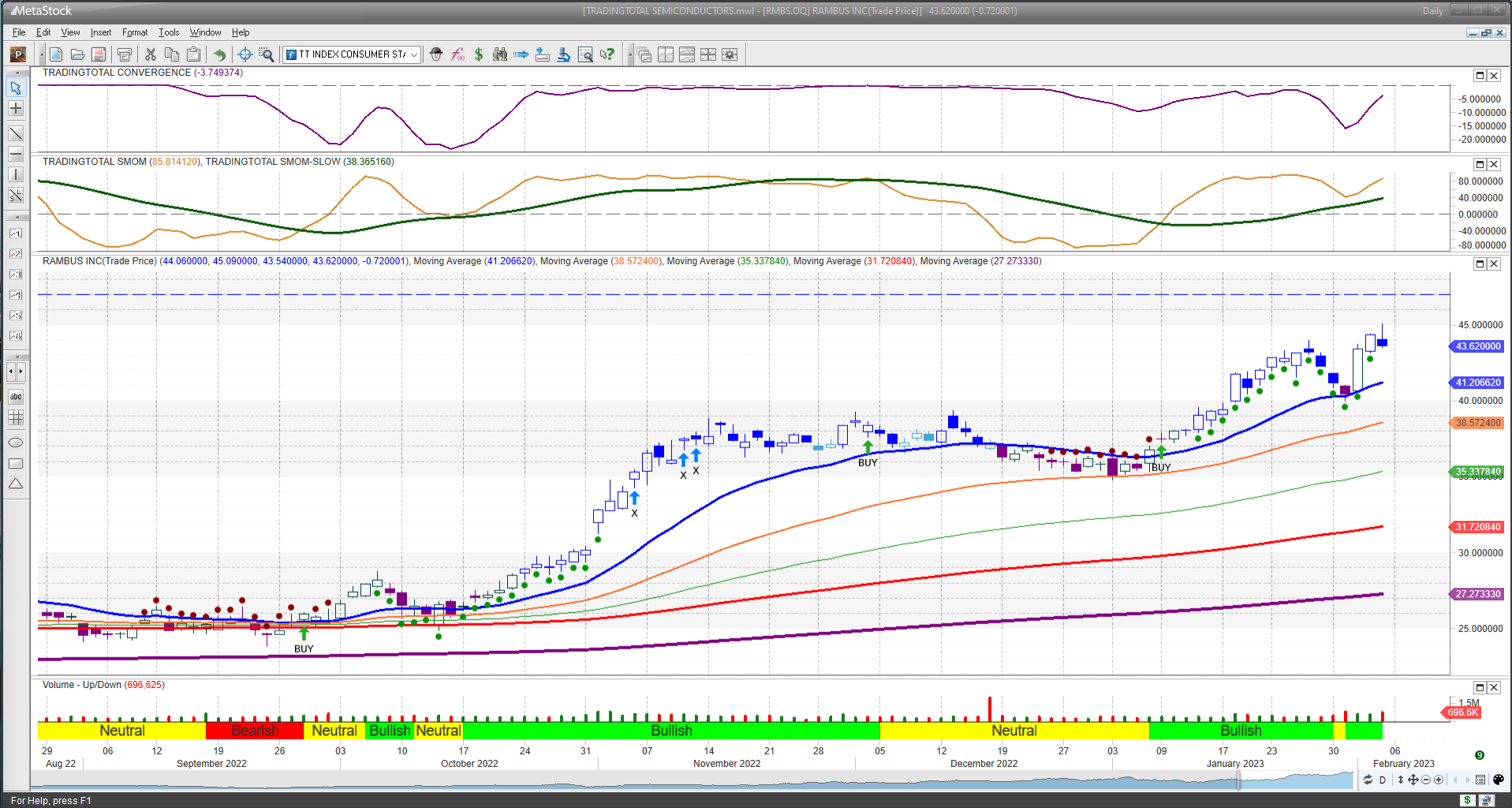

Regarding technology, we would like to talk a bit about the semiconductors sector, which is currently showing a remarkable resilience after a strong wave of layoffs were recently announced. Specifically, I would like to share the RMBS Daily Chart showing the e-globalTrading Alerts System into the 2006 year supply at 47 USD.

Note how the bullish momentum is being built-up on RMBS. Let’s see what happens next week.

RMBS Daily Chart provided by MetaStock, Alerts System provided by e-globalTrading – TradingVest USA

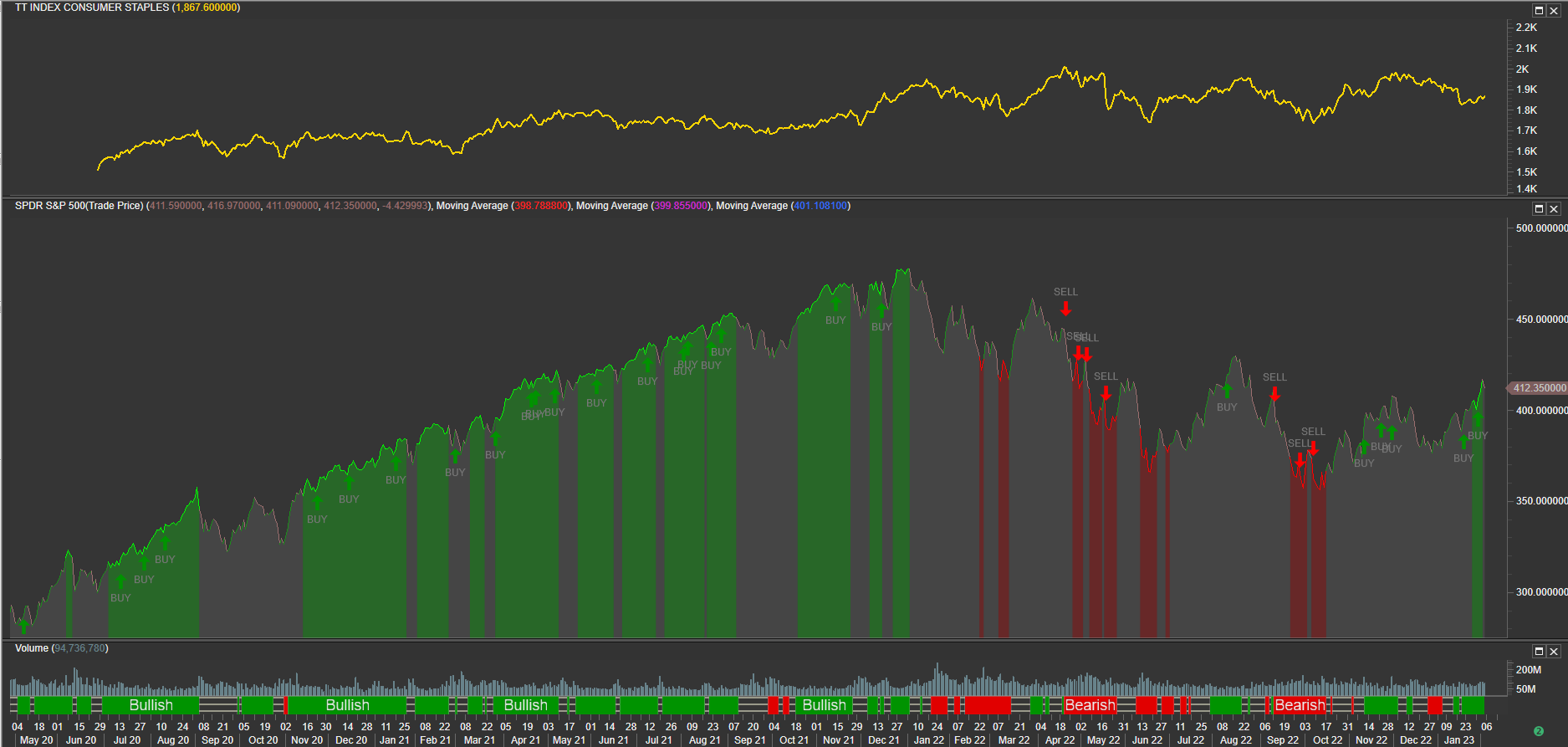

Finally, we would like to address the consumer market situation, with special focus on consumer staples, which is tracked by TradingVest following our proprietary TradingTotal Consumer Staples Index.

So, let me feature our TT INDEX CONSUMER STAPLES Index in Daily time frame, where we can observe the referred proprietary Index compared to the S&P ETF SPY, where we also added our e-globalTrading Alerts System.

TRADINGTOTAL INDEX CONSUMER STAPLES Daily Chart provide by MetaStock

Please observe that the TT INDEX CONSUMER STAPLES seems to be slightly lagging, compared to the broad market tracker SPY, which is a sensitive message for investors, if this situation continues. Big retailers Walmart and Target will be releasing very important information in just a few days, when both companies will be reporting results. Analyzing the sector constituents, we see several traditional companies looking more or less “technically complicated” with supply issues for some time. Stay tuned!