By Ed R. Gils – TradingVest USA President – March 6th 2023

One year after the Ukraine war began, there are more doubts than certainties about crude oil future price.

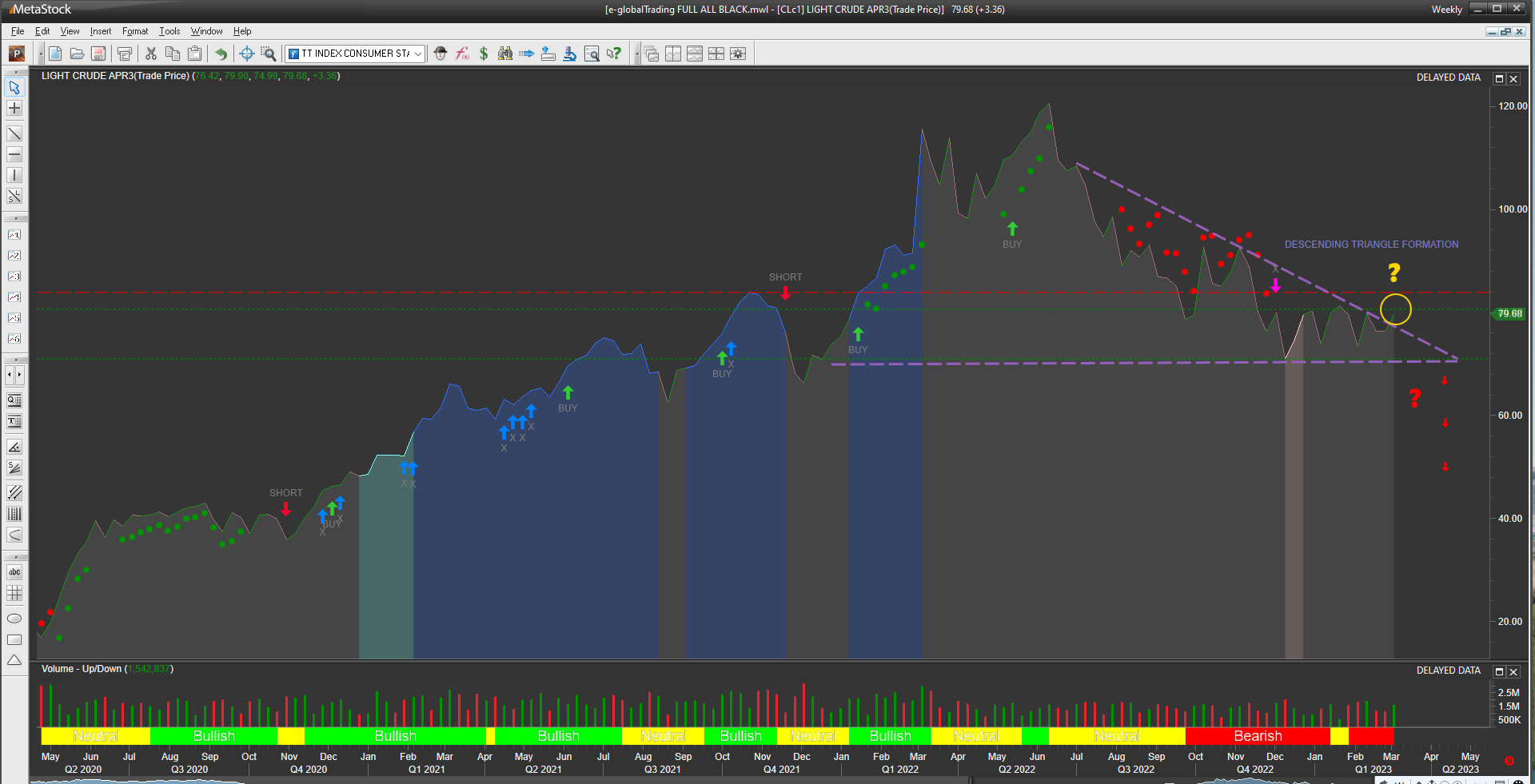

Crude Oil prices weekly chart shows CL making a solid downtrend move from the 120 USD price since June 2022, driving future prices into a wide support trading range between the 79 – 71 USD area.

Bullish players bet to higher prices due to tight supply and China higher demand. At the same time, bears expect lower prices due to lower than expected crude oil China consumption and current OPEC limited supply cuts policy.

However, there is a strong real fact both teams must agree with: Oil prices began to rise well earlier than Russia invaded Ukraine, as observed on the corresponding CL price chart.

Light Crude Daily Chart provided by MetaStock, SMART Alerts provided by e-globalTrading–TradingVest USA

The referred chart shows crude oil prices breaking through the 84 USD (red dashed line) level in mid-January 2022, about one month before Russian forces crossed Ukraine border. But the corresponding chart also shows a solid price uptrend since January 2021, one year earlier the beginning of the war. Also note the blue color background showing a strong up-momentum behavior for CL future prices.

Today, CL is trading inside a 9 USD trading range (71USD to 80 USD) confirming the mentioned fundamental uncertainty.

From the technical point of view the CL future instrument is showing a classic descending triangle technical formation, suggesting prices might breakdown below the 71 USD support pivot area, which was formed the first week of December 2022. Next support area is at 66 USD.

At the same time, classic technical analysis says that the hypotenuse of the referred descending triangle MUST be kept as a resistance, and CL price is precisely challenging the referred hypotenuse resistance line. If this CL price continues up and it cross over the 80 USD area we would be confirming the base of the triangle as a support, with the obvious bullish implications. So, prices would eventually have chances to challenge the next level of resistance, which is now right at the 91-92 USD area.

From the fundamental point of view, global demand for the rest of the year is still the big question to be answered, which is now impacted by global interest rates and China growth.

Once again, global economy doesn’t seem to be very comfortable with an oil price near to 100 USD, and at the same time a 50USD/barrel price was left behind since more than 2 years.

In short, we have to be prepared to possibly live with a high volatile 20-25 USD crude oil trading range.

Stay tuned!