by e-globalTrading

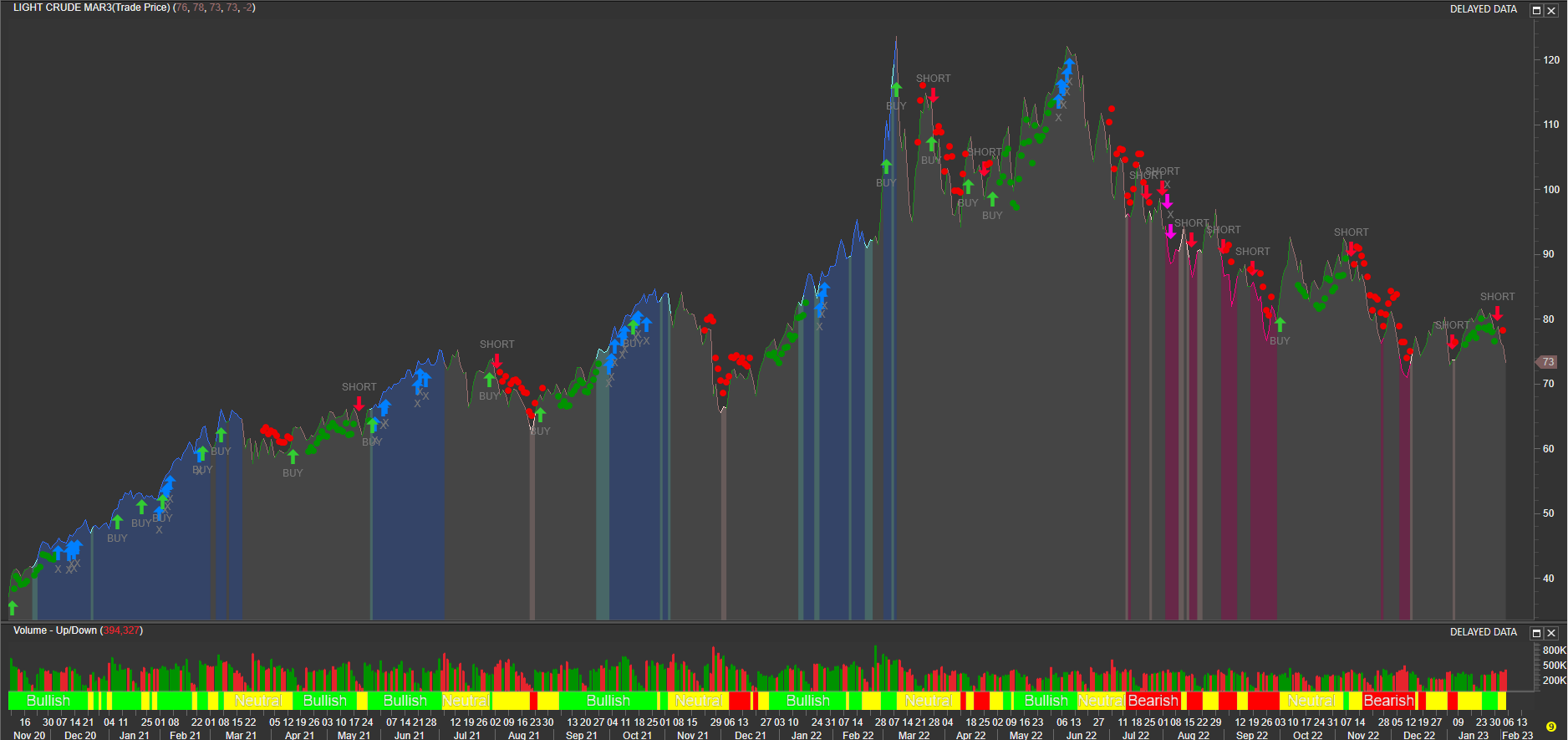

Crude Oil Daily Chart provided by MetaStock, SMART Alerts provided by e-globalTrading

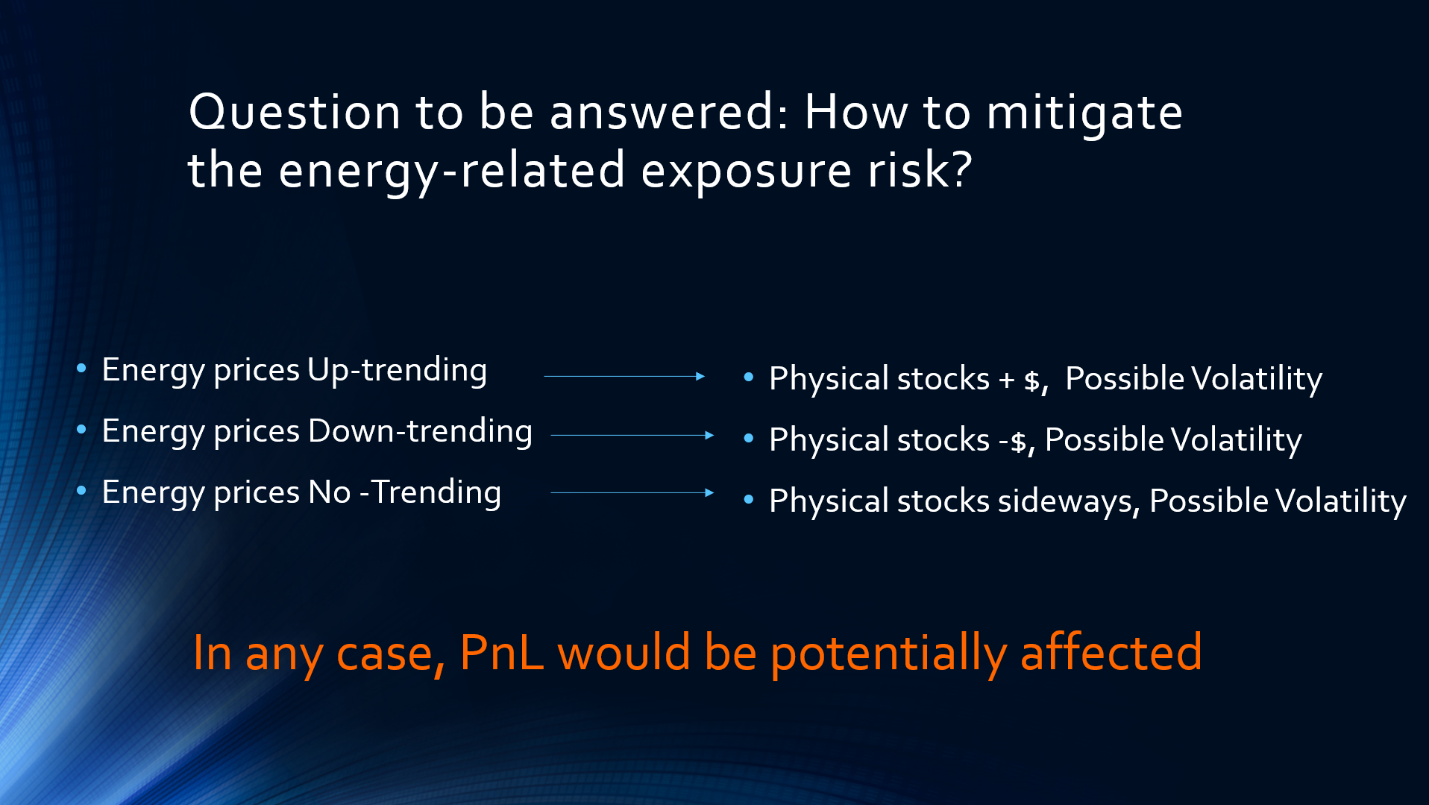

Whatever your business is, volatility is always a relevant factor, potentially affecting your profits.

The question is what you are specifically doing to mitigate the potential damage associated to the referred volatility situation, which is certainly impacting your products and services costs, such as raw materials prices, transformation and final products physical stock cost, sales prices and financing possibilities, among others.

According to Investopedia, “Volatility is a statistical measure of the dispersion of returns for a given asset or instrument or security. In most cases, the higher the volatility, the riskier the asset. Volatility is often measured from either the standard deviation or variance between returns from that same asset or instrument.”

Volatility is not bad or negative by itself, but depending on your specific case, it might impact negatively your business results.

But, going to the plain English level, what are we really talking about? At the same time, how your business could be protected for the referred volatility potential damage?

The potential impact of the last year energy volatility scenario will obviously depend on how strong energy derivatives are for your business product value composition.

But, in general terms for any petrochemical or plastics manufacturing process, this is the general situation we have to deal with.

e-globalTrading by TradingVest USA

e-globalTrading by TradingVest USA

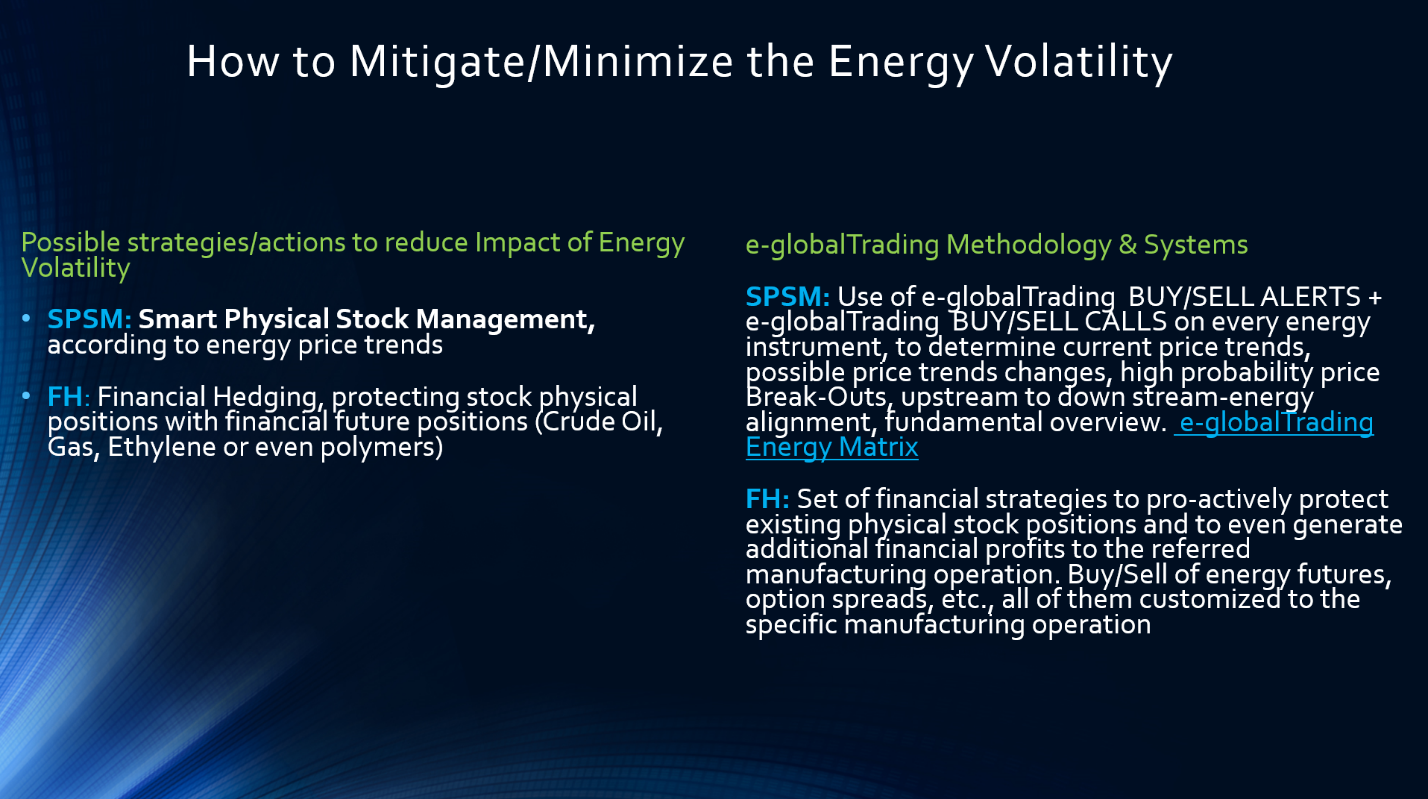

According to all those possible scenarios, e-globalTrading is able to work with you to find-out the best volatility protective strategy for you.

Read more about e-globalTrading products and services