by TradingVest Editorial Board

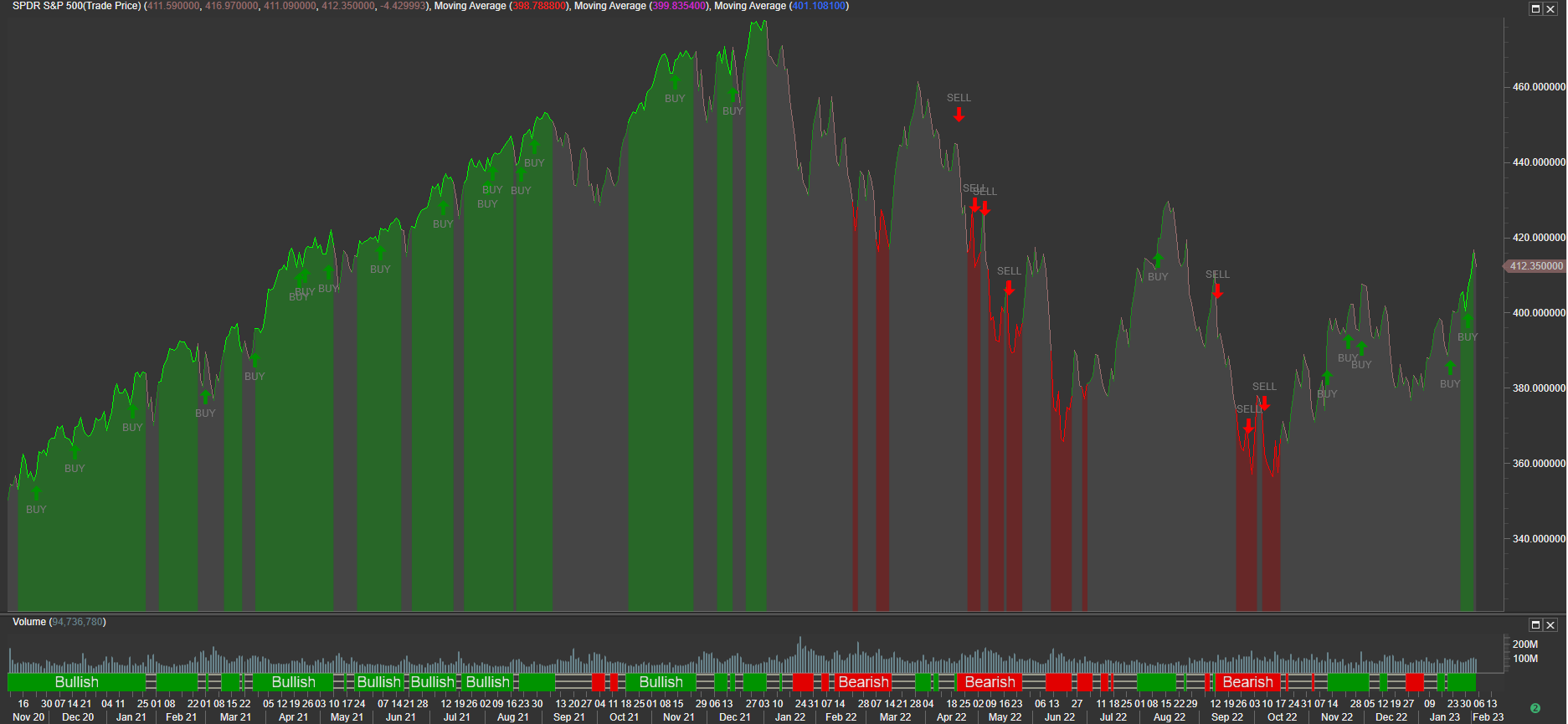

SPY Daily Chart provided by MetaStock, SMART Alerts provided by e-globalTrading-TradingVest USA

January 2023 showed several clues to investors and traders about coming months potential returns. Top-down analysis still shows a remaining underlaying inflation making pressure on FED to keep increasing interest rates, probably at a slower pace. But, we are certainly expecting a relatively higher interest rates scenario for some time.

This currently high-priced money for individuals and companies is already impacting several market sectors such as retail, housing, several consumer markets, and potentially to the financial sector.

Indeed, last week released market data was certainly illuminating to confirm the strong market condition in terms of resilience facing the current interest rates hike process conducted by the FED.

Some encouraging early signs of an inflation ease process have emerged, showing inflation moderately turning down over the past months, though it remains high. At the same time, the job market has shown pretty solid numbers, despite important layoffs in tech and other sectors; overall unemployment remains at several decades low.

Another recent positive signal on inflation was the small wages impact on the labor market; wages only were increased by 1 % during Q4, and last Friday February 3rd, the Labor Department informed another important data, the Average Hourly Earnings month to month for January 2023 was 0.3%, as expected.

However, Federal Reserve executives, are certainly perceiving all those positive tracking elements extremely cautiously, basically due their own late reaction to the potential economy overheating early signs, shown by the market during the final part of the severe pandemic period, between the end of 2012 and the beginning of 2022, because of the sustained stimulus benefits.

As a result of all this situation, last Wednesday the FED Chief Jerome Powell announced what it was widely expected by the market, a new interest rate hike of 0.25% on federal funds.

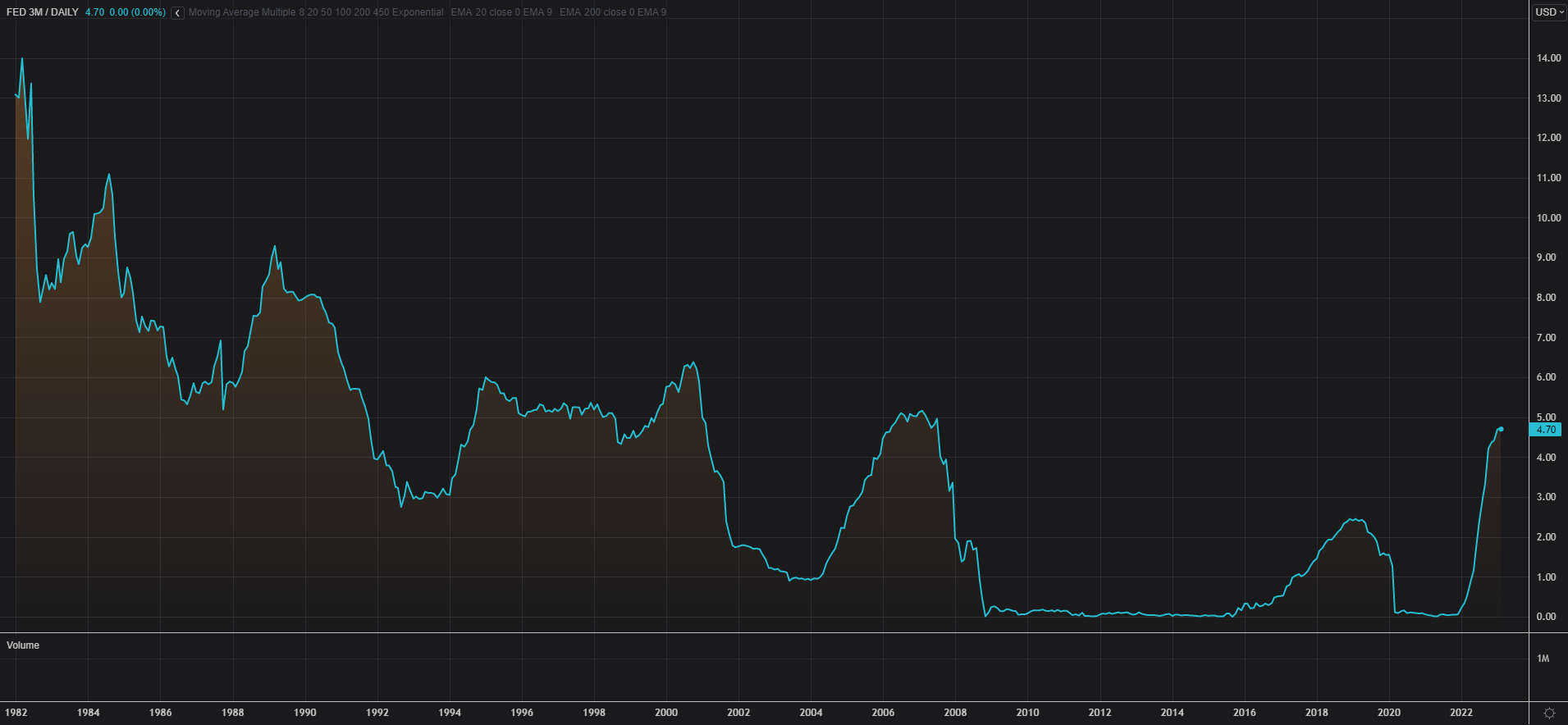

FED federal funds interest rate 3M tracker provided by Metastock-Xenith

According to FED Chair Jerome Powell, market continues showing early signs of deceleration without any significant labor market impact, but he said this is just the initial stage of the price decrease process. Next FED meeting to be held in March will analyze market reaction to the current 4.5-4.75 % federal funds interest rate to decide about the future interest rate increase path. According to Mr. Powell, inflation is still far away from the 2% inflation FED target so, is not time to pause the adjustment yet. Powell said that the Fed was planning “a couple more” increases, and that he expected rates to remain high through 2023.

FED also announced to continue shrinking its balance sheet to full fill the sort of money tightening measurements. At the same time, FED also sees wages starting to go down. However, FED expects the inflationary process will continue up in new housing sector before starting to see housing prices moving down. Analysts think this up-priced housing market is due to the supply side weakness, as a consequence of lack of a solid stock reposition for new homes after the 2008 financial crisis.

Finally, POWEL added that goods inflation went significantly down recently, which is a good sign of inflation ease.

Certainly, there were several announcements confirming what FED sees in several consumer sectors. On groceries, Whole Foods Market (Amazon) asked suppliers to help the company bringing prices down on groceries as inflation moderates. After a year of strong prices increase, consumers have been reducing purchases, buying cheaper versions of groceries or looking for more attractive deals.

On the discretionary market sector, automotive was not the exception. Automakers TESLA and FORD announced they are slashing prices on their EV series, showing a possible ultra-competitive situation for this sector. However, GM shows no intention to participate in any EV price fight. Last week, the giant automaker informed quarterly results, reporting and surprising $ 2 billion Q4 net profit, as a result of the past year serious supply chain hurdles improvements as well as a strong car price increase. Anyway, analysts foresee a strong competition down the road for the EV industry, with the obvious potential negative impact on the sector profitability.

Finally, big techs from the online advertising business, Apple, Amazon and Alphabet, another important market sector directly affected by the consumer market potential weakness, also reported results last week, posting disappointing results, basically due to a lagging advertising business, as well as the cloud business poor performance.

So, putting all together, under a potentially recessive scenario highlighted by interest rates hikes continuation, massive layoffs in the technology sector and some concerns about the consumer spending sector, the big question still remains unanswered.

Which market sector does currently look promising for investors?

We obviously see opportunities in the EV sector, even recognizing that the industry will face a strong competition scenario between TESLA, FORD and GM, but the EV market will continue making progress.

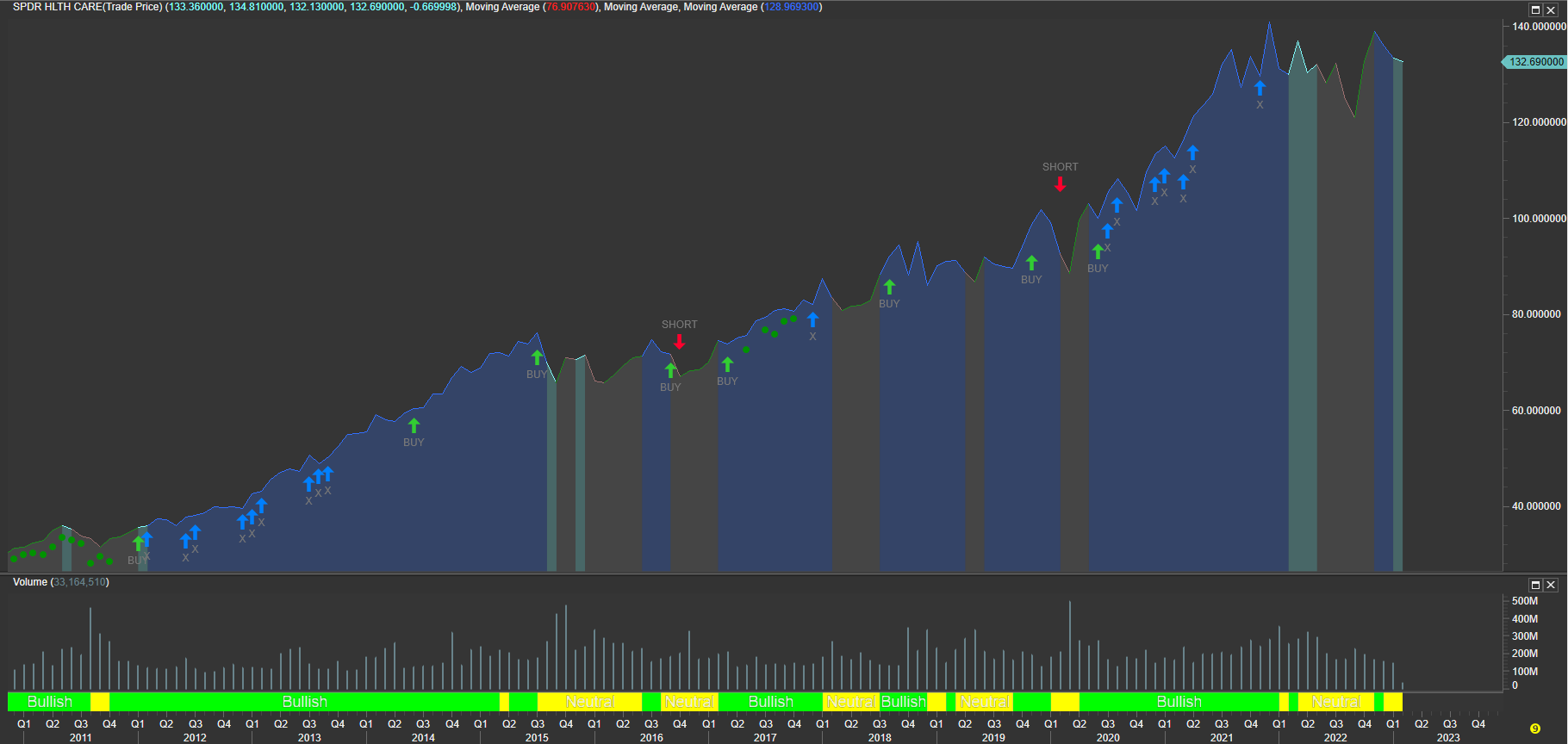

Health Care certainly looks like a reasonable risk option for investors; the health care sector is responsible for 18% of US GDP. Just note the solid long term XLV SPDR HEALTH CARE ETF solid up-trending behaviors since the year 2009.

XLV Health Care ETF Monthly Chart provided by MetaStock, SMART Alerts provided by e-globalTrading

Despite the disappointing results recently announced by the consumer staples giant Colgate Palmolive, probably due to COVID sanitizing practices ease and some consumer spending reshuffle, the sector probably represents an affordable risk for investors.

At the same time, there are good market news from the international market side. The industrial market has the real chance to add size for products and services to China, after the Chinese government COVID restrictions policy lift, and that’s a real extra energy jump for American markets.

Summarizing, the market seems to be weathering the huge challenge of digesting important interest rates hikes, apparently with no significant labor market disarray, except for the technology sector. Inflation also seems to be starting to ease, despite an underlying inflation remains. Regarding the consumer spending market, which take accounts of 70% of US economy, we still need to receive more updated data from other key retailers such as Walmart and Target (both will report by the end of February), as well as from the retail financial companies, which certainly have more risk exposure related to the consumer market. Stay tuned.